Bank’s Profile

A BRIEF HISTORY OF THE BANK SINCE ITS INCORPORATION

| Year | Key Events |

|---|---|

| 1907 |

|

| 1921 | Bank’s capital was raised to Rs 60 lakhs from Rs 20 lakhs. |

| 1932 |

|

| 1941 | Singapore branch was opened. |

| 1957 | Bank celebrated its Golden Jubilee. |

| 1967 | Bank celebrated its Diamond Jubilee. |

| 1978 | Bank’s logo comprising of three circling arrows arranged around a central point was approved. |

| 1982 | Bank celebrated its Platinum Jubilee. |

| 1990 | Bank of Thanjavur Ltd. (BoT) with 157 branches was amalgamated with the Bank. |

| 2006 | The centenary year celebration was inaugurated by His Excellency the President of India Shri A. P. J. Abdul Kalam on 4th September. |

| 2007 | Bank went in for Initial Public Offer in February 2007. |

| 2008 | Achieved 100 per cent Core Banking Solutions (CBS) compliance. |

| 2019 |

|

| 2020 | Bank commenced its operations as an amalgamated entity from 1st April 2020. The integration of CBS systems of both the Banks was completed on 14.02.2021. |

| 2022 | Bank’s Global Business surpassed Rs 10 lakh Crores. |

| 2023 | Bank’s Global Business was at Rs 10.95 lakh Crores. |

| 2024 | Bank’s Global Business surpassed ₹12 lakh Crore. |

| 2025 | Bank’s Global Business was at ₹13.25 lakh Crore. |

| Q3 FY26 | Bank’s Global Business stood at ₹14.30 lakh Crore. |

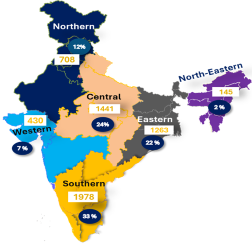

Branch Network and other touch points as on 31.12.2025

Domestic branches: 5965 (Including 3 DBUs) Overseas branches: 3 & IBU: 1

ATMs & BNAs: 5624 Business Correspondents: 16247

Bank’s Performance as on 31.12.2025

Assets and Liabilities

- Total Deposits increased by 12.62% YoY and reached to ₹790923 Cr in Dec’25 as against ₹702282 Cr in Dec’24. Current, Savings & CASA deposits grew by 19.13%, 8.45%, and 9.86% YoY respectively.

- Domestic CASA ratio stood at 39.08% as on 31st Dec’25.

- Gross Advances increased by 14.24% YoY to ₹638848 Cr in Dec’25 from ₹559199 Cr in Dec’24.

- RAM (Retail, Agriculture & MSME) advances grew by 16.65% YoY to ₹390459 Cr in Dec’25 from ₹334739 Cr in Dec’24.

- RAM contribution to gross domestic advances stood at 66.06%. Retail, Agri & MSME advances grew by 18.54%, 15.14% and 16.41% YoY respectively. Home Loan (including mortgage) grew by 14.20% YoY in Dec’25.

- Priority sector advances as a percentage of ANBC stood at 43.75% (₹215127 Cr) in Dec’25 as against the regulatory requirement of 40%.

Capital Adequacy

- Capital Adequacy Ratio improved by 66 bps to 16.58%. CET-I improved by 127 bps YoY to 14.54%, Tier I Capital improved by 77 bps YoY to 14.54% in Dec’25.

Asset Quality

- GNPA% decreased by 103 bps YoY to 2.23% in Dec’25 from 3.26% in Dec’24, NNPA% reduced by 6 bps to 0.15% in Dec’25 from 0.21% in Dec’24.

- Provision Coverage Ratio (PCR, including TWO) improved by 19 bps YoY to 98.28% in Dec’25 from 98.09% in Dec’24.

Operating Profit and Net Profit (Nine Months ended Dec’25 over Dec’24)

- Net Profit up by 13.69% YoY to ₹9053 Cr in 9MFY26 from ₹7962 Cr in 9MFY25.

- Operating Profit increased by 4.66% YoY to ₹14630 Cr in 9MFY26 from ₹13980 Cr in 9MFY25.

- Net Interest Income grew by 5.42% YoY to ₹19805 Cr in 9MFY26 from ₹18787 Cr in 9MFY25.

- Return on Equity (RoE) stood at 19.66% in 9MFY26.

- Cost of Deposit reduced by 10 bps to 5.02% in 9MFY26 from 5.12% in 9MFY25.

- Net Interest Margin (NIM) Domestic stood at 3.37% in 9MFY26.

Network

- The Bank has 5965 domestic branches (including 3 DBUs), out of which 2001 are Rural, 1592 are Semi-Urban, 1191 are Urban & 1181 are in Metro category. The Bank has 3 overseas branches & 1 IBU (Gift City Branch).

- The Bank has 5624 ATMs & BNAs and 16,247 number of Business Correspondents (BCs).

Digital Banking

- Business of ₹1,98,350 Cr has been generated through Digital Channels in 9MFY26. A total of 147 Digital Journeys, Utilities and Processes have been launched so far.

- Number of Mobile Banking users has grown by 21% year over year, reaching 2.25 Cr.

- UPI users and Net Banking users have witnessed an increase of 21% & 5% YoY reaching 2.52 Cr and 1.18 Cr respectively. Debit card & POS users increased by 7% & 15% respectively.

Awards & Accolades

- The Bank received prestigious SKOCH Golden Award for “IB SAATHI” and Silver Award for “Security Operations”.

- The MD & CEO of the Bank received “CEO of the Year” award at Tamil Nadu Business Leader of the Year, Industry-wise Awards 2025.

- Bank has received Special Mention under Best IT Risk Management & Best Technology Bank at IBA’s 21st Annual Banking Technology Conference 2024-25.

- Indian Bank has received “Narakas Rajbhasha Samman” (Third Prize in Region ‘C’) from the Department of Official Language, Ministry of Home Affairs, GoI.

- The Bank received “Red Hat APAC Innovation Award 2025” for Cloud Native Development.

- The Executive Director, Shri Brajesh Kumar Singh and Chief General Manager Shri Sudhir Kumar Gupta received “Executive of the Year” and “Chief General Manager of the Year” respectively at UP Banking Leadership Summit & Awards 2025 ceremony.

- The Bank received the VMware – India Cloud Leader Award 2025 in recognition of its leadership in cloud technology and innovation.

Our Focus

- Our focus is on building efficiency across operations to deliver faster, simpler, and more reliable banking experiences. We aim to maintain strong asset quality through prudent lending and disciplined portfolio management. We remain committed to the highest standards of governance and regulatory adherence, ensuring transparency and trust. At the core, growth will be driven by customer centric initiatives expanding digital access, strengthening CASA and MSME offerings, and providing responsive service to meet evolving needs.